Spring 2025. Over coffee, an e-commerce director confided: “I’ve just reviewed my paid campaigns… CPC is up 38% year-on-year. But sales are flat. I’m starting to feel like I’ve become dependent.” He’s not the only one. In a market under pressure—where acquisition costs are rising faster than margins—the marketing equation is becoming increasingly unstable. With ad inflation squeezing budgets, acquisition leads are feeling the strain. But where’s the oxygen?

What if the answer has been hiding in plain sight—underused, dormant, waiting?

SEO, once seen as “slow or complex,” is now emerging as a strategic profitability lever, capable of reconciling CAC control with sustainable performance.

This article offers a pragmatic case for rethinking SEO—not as a cost centre, but as a performance asset that drives ROI.

And because SEO is undergoing a major shift, we’ll go further—exploring GEO, the new frontier for SEO in the AI era. A transformation that could reshape your entire performance mix.

E-commerce context: CAC overheating, ROI suffocating

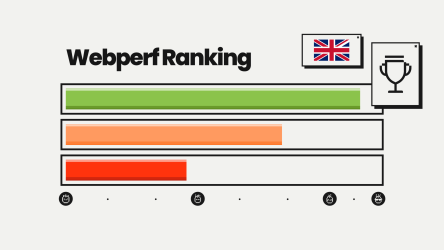

Since early 2025, e-commerce acquisition teams have been navigating choppy waters. Cost-per-click (CPC) has surged, making performance media more expensive and less predictable. According to WordStream’s 2025 Google Ads Benchmarks, average CPC in the US has reached $5.26, peaking at $8.58 in legal services and $7.85 in home & garden. Of the 20 industries analysed, 87% have seen CPC increases, with sectors like beauty and education facing hikes of over 40%.

The outcome is clear: same budgets, weaker results. ROAS erodes, campaign profitability softens, and CAC spirals. This structural imbalance is threatening for e-commerce models that rely heavily on paid acquisition—particularly DNVBs and emerging brands. Ad inflation is no longer a marginal trend; it’s a systemic reality.

Why SEO is regaining strategic importance in E-commerce

Faced with ever-rising paid acquisition costs, SEO is regaining traction as a strategic alternative. Unlike paid campaigns that demand constant spend, SEO operates on an investment model: every piece of content, every technical fix becomes a durable asset—delivering organic traffic with no marginal cost.

According to First Page Sage’s 2025 SEO ROI Report, the average SEO ROI for e-commerce is 317% over three years, with break-even typically reached by month 16. In some sectors—real estate, for instance—ROI climbs as high as 1,389%, generating £13 for every £1 invested. Far from being a secondary channel, SEO is becoming a CAC buffer. It reduces reliance on ads, flattens acquisition costs over time, and improves overall profitability. For e-commerce players, it’s a strategic hedge against auction volatility—and still vastly underleveraged.

SEO: A long-term lever to align CAC and LTV

The biggest challenge in budget planning today is breaking away from the “short-term ROI” reflex. Too often, channels are evaluated based on their ability to deliver immediate results, overlooking the fact that real profitability plays out over the entire customer lifecycle. And that’s precisely where SEO outperforms.

Unlike paid media, SEO CAC doesn’t grow linearly with scale. A well-positioned content asset can generate qualified traffic for years, with zero incremental cost. According to SeoProfy, a well-optimised e-commerce site typically reaches positive ROI in 6 to 12 months, with an average organic conversion rate of 2.4%.

What matters most is the compounding effect: when a product ranks on multiple relevant queries, it drives recurring, high-intent traffic—naturally lowering the average CAC month after month. In short, SEO reduces CAC as it gains momentum—exactly the opposite of paid.

Aligning CAC and LTV: the winning formula

For any acquisition lead, the goal is to align CAC with LTV (lifetime value). A solid benchmark targets an LTV:CAC ratio of 3:1. SEO is the channel that optimises this equation best.

Consider this: a typical customer spends £60 per order, three times a year, for two years. That’s an LTV of £360. If acquired via paid media at a £120 CAC, your ratio is 3:1—but any cost increase quickly erodes margin. If the same customer is acquired through SEO, with a CAC of just £30, the ratio jumps to 12:1—freeing up headroom to reinvest at scale.

SEO also contributes to LTV through indirect levers: educational content, cross-sell recommendations, seamless non-intrusive funnels… It improves the customer experience, boosts loyalty and drives repeat purchases. In short, it becomes a post-acquisition activation lever—something paid can only support marginally.

Budget allocation shouldn’t pit SEO against paid. Instead, brands should adopt a performance mix mindset. SEO reduces CAC and fuels LTV growth—a rare and strategic alignment for any e-commerce business aiming for profitability and resilience.

Giving SEO the budget it deserves

Despite its demonstrated ROI, SEO often remains underfunded. Why? Because its returns are delayed. In fast-paced, quarterly-driven environments, instant metrics dominate. Naturally, performance marketers lean towards short-term returns. This bias is especially visible in e-commerce teams where dashboards revolve around paid ROAS.

But with a long-term lens, SEO consistently delivers superior net ROI, and with much lower volatility. A Terakeet study found that SEO drives 12.2x more traffic than paid media, on equivalent budgets.

Put simply: SEO isn’t lacking in ROI—it’s lacking in financial storytelling.

Three practical frameworks to defend the SEO Budget

To restore SEO’s place in your performance mix, use simple and robust models that speak finance’s language:

1. Forecast ROI per keyword

Example: target “designer office chair” (2,000 monthly searches). Position #3 captures ~10% CTR = 200 visits. With a 2% conversion rate and £150 basket, that’s £6,000/month in revenue. If optimisation costs £6,000, you reach break-even in one month.

2. Compare organic value to equivalent paid spend

Tools like Semrush and Ahrefs estimate how much your organic traffic would cost if bought via ads. That “organic value” is a compelling way to quantify saved media spend.

3. Highlight indirect impacts (support, brand, retention)

A strong FAQ reduces support volume. High-ranking content earns backlinks. A well-structured organic funnel increases purchase frequency. These value drivers should be included in your extended ROI calculations.

These frameworks help you speak the language of financial planning—tangible, measurable, and comparable metrics. And that’s often all it takes to unlock budget.

SEO isn’t just another channel. It’s a strategic asset. And like any asset, it deserves to be valued. Bring forward metrics that align with how other channels are measured, and you’ll finally give SEO its rightful place: as a cornerstone of profitability.

GEO: SEO Reimagined for the Age of AI

GEO (Generative Engine Optimisation) is an emerging SEO discipline focused on optimising content for generative AI engines (LLMs) like ChatGPT, Gemini or Bing Chat. The goal? Ensure your content is extracted and cited directly within AI-generated answers, effectively landing a “position zero” in the search experience.

Unlike classic SEO, which targets SERP rankings, GEO is built for AI-driven information retrieval: clearly defined entities, Q&A formatting, logical structures… These are the traits that increase your content’s chances of being surfaced by large language models. Explore the full analysis on Search Engine Journal

Why GEO is a breakthrough for E-commerce SEO

For e-commerce teams, GEO opens a new visibility frontier. Product pages, buying guides, category content and FAQs can all be structured to feed generative engines, capturing indirect traffic—even without a click.

According to Search Engine Journal, content most frequently extracted by AI engines tends to feature clear logical structure, descriptive headings, concrete data, and consistent semantics. Q&A formats, bullet points, tables, and clean summaries are especially effective.

Walker Sands noted in late 2024 that 43% of B2C marketers had already begun integrating GEO logic into their content strategy—primarily to boost their presence in SGE (Search Generative Experience) interfaces. GEO-ready content becomes a resource-light visibility surface, beyond traditional SERPs, with strong conversion potential—if semantically structured from the ground up.

Acquisition Teams: What to expect from GEO

Adopting GEO requires concrete steps: FAQ-driven page structures, extractable data, fine-tuned semantic modelling… But the returns can be significant:

-

AI-first visibility – Get featured in generative answers, bypassing traditional rankings.

-

Long-tail resilience – GEO content performs even without frequent updates.

-

SEO synergy – GEO improvements often boost classic SEO performance too.

For e-commerce acquisition teams, this means a new visibility surface with zero cost-per-click, a way to cut paid dependency, and a high-impact SEO lever when executed well.

GEO isn’t hype. It’s SEO’s natural evolution in the AI age. Structuring content to be understood, extracted, and cited by LLMs is fast becoming essential for brands looking to maintain—or grow—their organic visibility over the next few years.

In 2025, SEO isn’t optional. It’s the rational choice.

The numbers don’t lie. Acquisition costs are climbing. Paid performance is becoming volatile. And yet, many teams still underinvest in the only channel that drives compound ROI over time: SEO.

This isn’t a trend—it’s a shift. Not a cost—it’s a buffer. Not just another lever—it’s the only one you truly own.

That’s where tools like EdgeSEO change the game. By enabling you to deploy SEO recommendations independently of IT cycles, scale the creation of GEO-ready pages, and accelerate your organic potential, EdgeSEO brings what SEO often lacks: agility. Speed. Speed to value.

In 2025, it’s not just about doing SEO. It’s about doing it faster, better, and at scale.

And that’s exactly what EdgeSEO delivers.

SEO won’t promise you the immediate.

But it guarantees the durable. And in 2025, that’s not just a luxury—it’s a strategy.One that can finally be driven by ROI.