As we head into Black Friday and Christmas, performance is more critical than ever.

- 38% of UK sites now pass all Core Web Vitals, steady progress since summer.

- E-commerce leaders (IKEA, Aldi, John Lewis) are ready for peak traffic.

- Media remains fast but less stable, with drops in CLS.

- Travel improves slightly, yet still the slowest sector overall.

💡 The winners this month? Teams that kept optimising while others paused. Every millisecond will count this holiday season.

It’s time to take a look at this month’s webperf rankings of the most visited sites in the UK.

We’re excited to unveil the new edition of our UK Speed Ranking : a snapshot of real-world mobile performance across four key sectors : Top 50 most visited, 🛒 E-commerce, 📰 Media and 🧳 Travel.

But before diving into the results, let’s remind ourselves why fast-loading websites are critical to online success.

📊 How the rankings are calculated ? The PX Index methodology.

As a reminder, the score obtained for the sites presented in this article is calculated using a methodology based on CrUX (Chrome User Experience Report) data. In order to give the best evaluation of each site’s mobile web performance, we based our calculations on the weighting of the Lighthouse score :

CrUX provides an overall assessment of the Core Web Vitals metrics for each site analysed. This metric is calculated by taking the 28-day rolling average of the 75 percentile performance throughout the month. The overall performance score is determined by a weighted average of the scores for each metric. This score, rated out of 100, is used in the rankings below (so it is not the PageSpeed score that is used in the rankings below). At Fasterize, we’ve made a clear choice: to rely exclusively on real-user data. That’s the foundation of the performance experience index (PX Index).

Why speed matters ?

Speed isn’t just technical : it’s strategic ! Studies show that website performance directly impacts user experience, conversion rates, and revenue. According to Google, 53% of mobile site visitors leave a page that takes longer than three seconds to load. For UK e-commerce sites, this statistic is particularly concerning given the intense market competition.

A Deloitte study reveals that a 0.1-second improvement in mobile site speed can increase conversion rates by 8.4% for retail sites. These figures highlight the importance of prioritizing loading speed to stay competitive.

Top 50 : Webperf ranking of the top 50 most visited websites in the United Kingdom

After the back-to-school rush, Q4 officially kicks off the most demanding time of the year for digital performance.

With Black Friday and Christmas campaigns approaching, every millisecond matters. Teams have entered the final stretch before the code freeze: the moment where performance tuning stops and scalability is put to the test.

This month’s ranking shows a clear divide:

some teams have maintained or even improved their metrics since summer, while others are already feeling the weight of heavier content, tracking scripts, and campaign assets. Let’s take a closer look at who’s ready for the holiday traffic surge: and who still has work to do.

🏆 TOP 3 LEADERS

The podium remains unchanged, showing remarkable consistency at the very top:

- Wikipedia (0) : A flawless 100 score, 862 ms LCP and 95 ms INP: fast, stable, and reliable.

- Indeed (0) : 99 score and sub-110 ms interactivity, a model of efficiency.

- Gov.uk (0) : 682 ms LCP, proving government services can also deliver exceptional web performance.

🌟 NOTABLE IMPROVEMENTS

Several players stand out this month for their post-summer optimisations:

- Etsy (+3 → #12) – Small but meaningful progress (–27 ms LCP, –4 ms INP) — fine-tuning pays off.

- Netflix (+3 → #43) – Major recovery: –869 ms LCP and –381 ms INP, closing the gap with faster content loading.

These sites reflect ongoing efforts to improve web performance, which will likely continue to positively impact user experience and engagement. These improvements are the result of consistent efforts to optimize their systems, with particular attention paid to INP. It’s worth noting that having a good FID does not necessarily mean having a good INP! FID only measures the first interaction, whereas INP assesses interactivity throughout the entire browsing session. The efforts made by these players to improve their web performance metrics are not only beneficial for their rankings but are also crucial for providing a quality user experience, reducing bounce rates, and increasing engagement on their platforms.

📉 CHALLENGES IN THE RANKINGS

Other sites struggled to maintain summer performance levels:

- News.sky (–5 → #16) – +49 ms on LCP and a CLS now in the orange zone — instability that risks frustrating readers.

- The Sun (–4 → #24) – +373 ms LCP and +62 ms INP; slower pages just as news consumption peaks.

- Daily Mail (–4 → #30) – +65 ms LCP and +21 ms INP.

- Microsoft (–3 → #40) – Degradation across the board (+96 ms LCP, +123 ms INP).

📊 Averages for the sector:

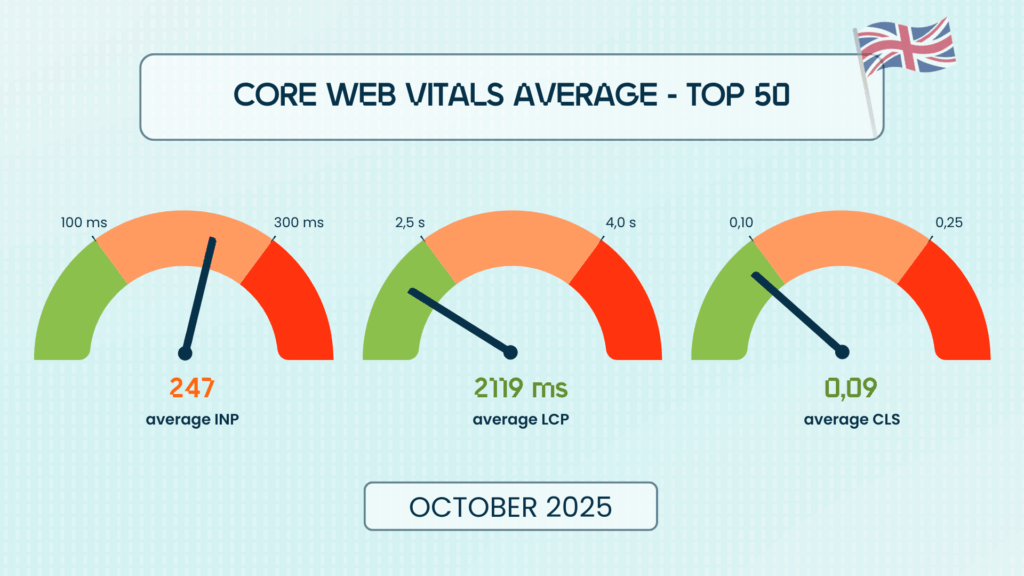

🧪 Core Web Vitals Overview – Top 50 (October 2025)

- ✅ 38% of sites pass all three Core Web Vitals (+10 pts vs August).

- ⏱ 70% meet the LCP benchmark — a stable indicator of fast content delivery.

- 🧭 48% (vs 52% last month) pass the INP threshold — a slight dip, but interactivity remains the key challenge.

- 🔒 76% (vs 72%) now have a green CLS, reducing disruptive layout shifts during browsing.

💡 Takeaway: While the podium remains unchanged, overall progress continues. The gap between the fastest and the rest is narrowing, but maintaining this pace during the holiday traffic surge will be the real test.

Here are the e-commerce rankings, for which web performance is a business and SEO issue.

E-commerce : Webperf ranking of the top 30 most visited sites in the United Kingdom

The race is on for retail performance.

October marks the final stretch before Black Friday and Christmas campaigns — a period where speed and stability directly impact conversion. Some brands clearly used September to optimise; others still have work to do before peak season.

🏆 TOP 3

No shake-up at the very top:

- IKEA (0) – Still untouchable with 1.29 s LCP and a near-perfect 140 ms INP.

- Aldi (0) – Efficient and stable, 1.56 s LCP, 142 ms INP.

- John Lewis (0) – Consistent performance: 1.27 s LCP, 157 ms INP.

🌟 NOTABLE IMPROVEMENTS

Some retailers clearly made good use of August to sharpen user experience:

- Halfords (+3 → #20) – Gains across all metrics (–31 ms INP, –0.04 CLS), though layout stability still needs work.

- Tesco (+3 → #21) – Better interactivity (–80 ms INP), improving shopping flow.

- Pretty Little Thing (+2 → #4) – Keeps climbing after last month’s surge, trimming –15 ms LCP and –19 ms INP, finally pushing INP below 200 ms.

📉 CHALLENGES IN THE RANKINGS

Some big names, however, lost ground:

- Matalan (–2 → #16) – Slight slowdowns (+36 ms LCP, +41 ms INP) that risk lowering conversion.

- Apple (–5 → #25) – Regression across all fronts (+376 ms LCP, +14 ms INP, +0.01 CLS).

📊 Averages for the sector:

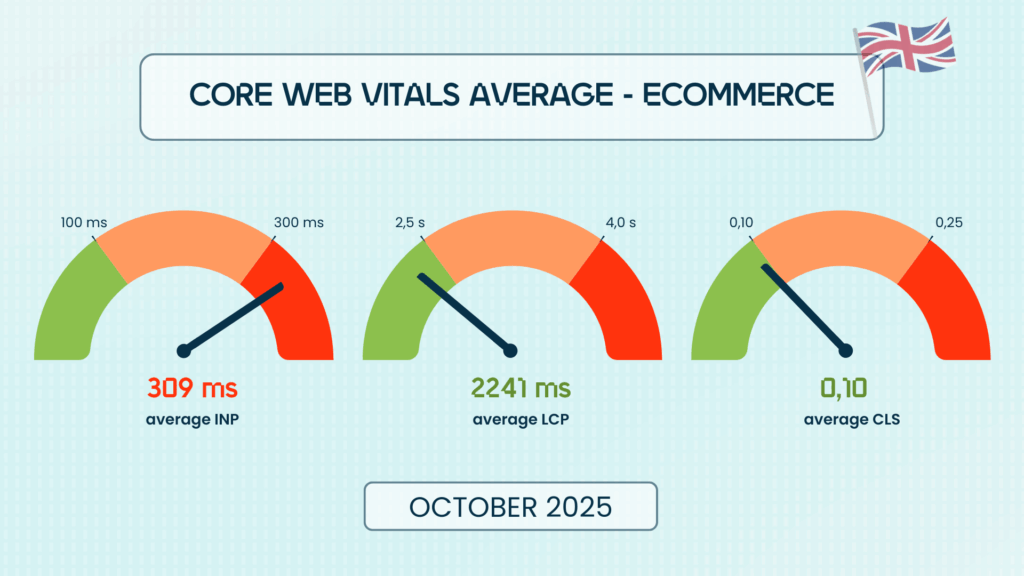

🧪 Core Web Vitals Overview – E-commerce (October 2025)

Performance remains mostly stable, with modest gains in stability but still too few sites meeting all benchmarks.

- ✅ 29% of e-commerce sites pass all 3 Core Web Vitals.

- ⏱ 70% have a green LCP, meaning main content loads fast for most users.

- 🧭 32% meet the INP benchmark: showing progress on interactivity thanks to recent optimisations.

- 🔒 70% display a green CLS, ensuring stable shopping and checkout experiences.

💡 Takeaway: The e-commerce sector is entering the holiday rush with solid loading speeds but still lacks fluid interactivity. Sites that optimise INP now could see the biggest gains during peak sales.

Media : Webperf ranking of the top 30 most visited sites in the United Kingdom

Autumn marks a crucial time for media websites: audiences are back from holidays, news cycles are intensifying, and readers expect instant access and seamless navigation.

This month, stability at the top meets strong comebacks lower down: proof that newsroom performance teams are still pushing hard before the end-of-year rush.

🏆 TOP 3 LEADERS

- The Guardian (0) – Continues to lead with near-perfect balance: 894 ms LCP, 117 ms INP, and stable CLS at 0.05.

- BBC (0) – Holds second with exceptional consistency, combining lightning-fast rendering (873 ms LCP) and flawless stability.

- Sky Sports (0) – Delivers impressive speed (125 ms INP), keeping sports fans engaged in real time.

Several outlets made measurable progress this month, a welcome sign as traffic ramps up:

- Sporting Life (+7 → #19) – Strongest rise of the month, cutting –305 ms on LCP (now green) and improving interactivity.

- Racing Post (+5 → #7) – Enhanced both loading and interactivity (–77 ms LCP, –13 ms INP).

- GB News (+5 → #11) – One of the best optimisations overall: –566 ms LCP, –33 ms INP, significantly boosting perceived speed.

- Hello Magazine (+3 → #10) –118 ms LCP, improving above-the-fold content rendering.

- London South East (+3 → #14) – Better visual stability (–0.03 CLS, now green) and faster loading.

- Good Read (+3 → #21) – Minor LCP optimisation (–12 ms), continuous progress counts.

- News Now (+3 → #22) – Small but positive step forward (–6 ms INP).

📉 CHALLENGES IN THE RANKINGS

Some publishers suffered visible slowdowns, mainly on loading and interactivity, two key drivers of engagement:

- The Sun (–8 → #16) – Heavy degradation (+373 ms LCP, +62 ms INP) at a critical moment for ad revenue.

- The Scottish Sun (–9 → #18) – Similar slowdown across all metrics (+403 ms LCP, +63 ms INP).

- Daily Record (–5 → #25) – INP worsened (+80 ms) and CLS rose (+0.03, now orange).

- Manchester Evening News (–4 → #26) – Overall degradation (+15 ms LCP, +69 ms INP, +0.02 CLS).

- Wales Online (–3 → #24) – +81 ms INP and a CLS drift to orange, smooth reading experience at risk.

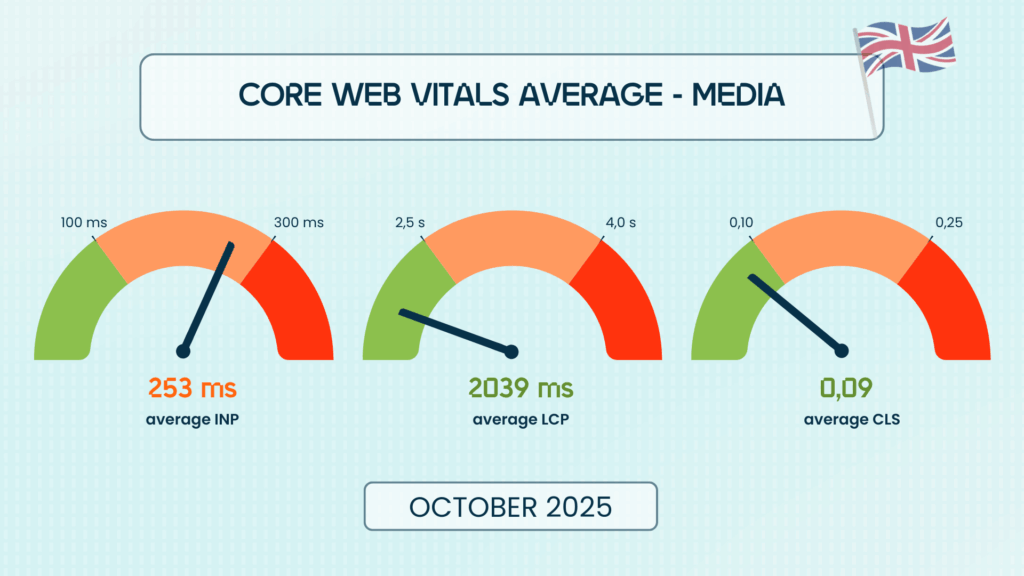

📊 Averages for the sector:

🧪 Core Web Vitals Overview – Media (October 2025)

- ❌ 33% of UK media sites meet all three Core Web Vitals , even seasoned publishers continue to struggle.

- ⏱ 87% deliver fast loading (LCP in the green), readers access stories almost instantly.

- 🧭 36% meet the INP benchmark, confirming that sluggish interactivity remains the weak link for the sector.

- 🔒 70% (down from 77%) maintain a stable layout (CLS green), a worrying dip that could affect reader comfort.

💡 Takeaway: Media sites are keeping pace on speed but losing ground on stability and responsiveness, critical factors as audiences expect frictionless reading experiences across devices and channels.

Travel : Webperf ranking of the top 30 most visited sites in the United Kingdom

As the holiday season approaches, travel websites face mounting pressure. Users expect fast, seamless experiences when booking flights, trains, and hotels, especially as they start planning end-of-year getaways.

After several months of slow progress, this sector shows modest improvement, but it remains the slowest performer across all industries.

🏆 TOP 3 LEADERS

- Transport for London (+1 → #1) – Reclaims the top spot with an excellent 115 ms INP and solid overall consistency.

- Love Holidays (–1 → #2) – Slightly improves its LCP (–19 ms) but loses first place due to a higher INP.

- Pitchup (0 → #3) – Maintains its position with stable results, though its 225 ms INP still leaves room for improvement.

🌟 NOTABLE IMPROVEMENTS

Several travel players used October to optimise before peak booking season:

- Uber (+3 → #12) – Strong comeback with –233 ms LCP, improving time-to-content significantly.

- EasyJet (+3 → #23) – One of the best improvements this month, achieving a triple optimisation:–92 ms LCP, –44 ms INP, and –0.09 CLS — smoother, faster, and more stable pages.

📉 CHALLENGES IN THE RANKINGS

No major regressions this month, though several sites lost two places due to smaller improvements elsewhere. The trend remains positive overall, but consistency will be critical heading into the high-traffic winter months.

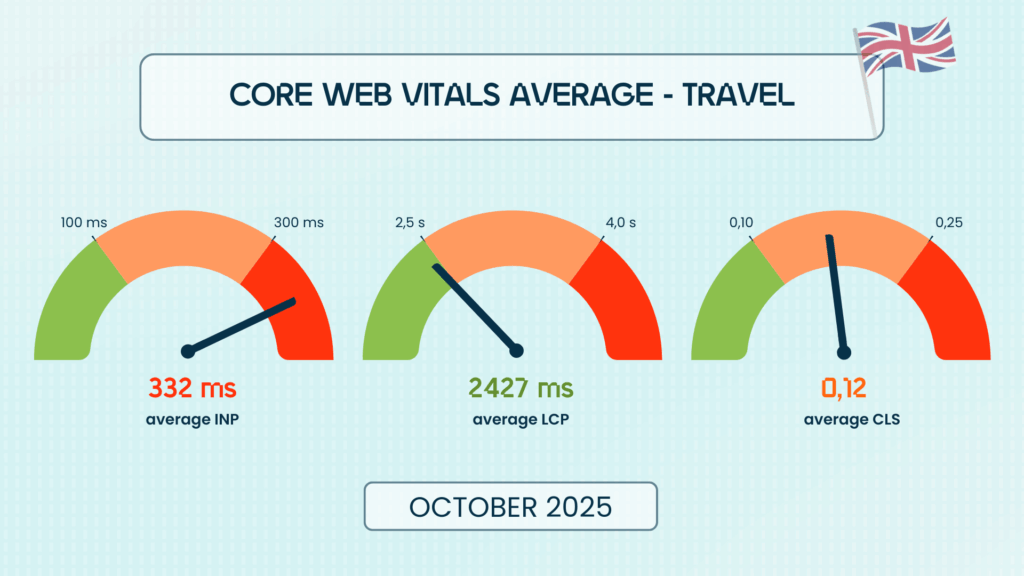

📊 Averages for the sector:

🧪 Core Web Vitals Overview – Travel (October 2025)

Despite some progress, travel remains the lowest-performing vertical in the UK Speed Ranking.

- ✅ 15% of travel sites now pass all three Core Web Vitals (up from 11%).

- ⏱ 52% meet the LCP benchmark, nearly half of sites still load too slowly.

- 🧭 30% (vs 22%) reach a green INP, showing early signs of progress in interactivity.

- 🔒 52% (vs 48%) achieve a green CLS, slightly reducing layout instability.

💡 Takeaway: While the sector is finally showing movement, travel brands still have work to do. In such a competitive, conversion-driven market, even minor lags in booking flow or content rendering can mean lost revenue, especially in the weeks leading up to Black Friday and Christmas travel spikes.

In such a competitive market, standing out through your website’s performance is essential. Fast loading times not only improve user experience but also increase conversion rates and generate more revenue. This monthly ranking is a valuable tool to measure and enhance your site’s performance, allowing you to position yourself against competitors and identify areas for improvement.

We encourage all UK e-commerce leaders to invest in optimizing their site speed and to explore how tools and services like those we offer at Fasterize can help unlock faster, smoother, and more profitable digital experiences to stay competitive. Stay tuned for the next edition to see how your competitors evolve — or how you can overtake them.

Where does your site stand in the UK webperf ranking?

Test your website’s performance in just 1 click with our new simulator.

Run a full web performance diagnosis in minutes. See exactly how you stack up against the leaders in this ranking.

- ✅ Check your Core Web Vitals (LCP, INP, CLS)

✅ Benchmark your site against your industry

- ✅ Get your Performance Index Score

- ✅ Receive personalised recommendations

✅ Analyse your performance trends over the past 6 months